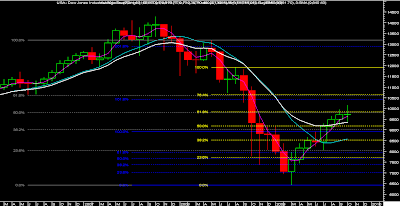

DJI全月只微涨0.45点,虽然10月内指数有数次突破10000点.

但始终并没多大的挺进.

11月份的走势会如何?

以中期的角度来分析,DJI应守在9379点的支持位之上,以延续第3波的涨势.

预测的目标点在10529.

如是强波目标点则在12056.

如DJI失守9379点,调整波正式开始.重要支持在8911点.

预测11月分波动空间

8660-10766

预测本周波动空间

9329-10097

中期支持与阻力参考

阻力点 10355; 10657 ;10958

支持点 9355 ; 9108 ; 8860

以目前的点位和均线系统来看,DJI走势有走弱迹象但还为出现悲观的离场讯号.

新加坡海峡指数(STI)

总结10月份,新加坡海峡指数(STI)的走势.

STI全月微跌21.44点,10月份走势较为平坦.

以中期的角度来分析,STI正处于盘整阶段.

目前并没显示多大走势方向.

如要延续涨势2576需要守着.

如失守2576调整波将会显现.

重要支持在2249点.

预测11月分波动空间

2366-2936

预测本周波动空间

2552-2750

中期支持与阻力参考

阻力点 2758; 2870 ;2961

支持点 2437; 2249 ;2098

如股友们有留意,我之前减仓的预警.

相信在这波的调整波的来临前,

都可避开不必要的损失和保主大部分的盈利.

但我并不建议股友卖光股票离场,毕竟市场还不至于那么悲观.

适度的作出资金和投资组合调整是策略上的需要.

下周一,股市开盘或许会出现较大的跌幅.

手持现金的股友,在还未理清走势方向前,忌入市抢反弹.

2009 FOMC MEETINGS 在3和4号.

周三至周五的波动会比较激烈.

适合投机客的玩法,保守者建议观望.

No comments:

Post a Comment