综合指数本周随着区域股市出现较大波动,周波动达20点.

综指在连跌4日后,周五全面回弹.

指数以1360.15点挂收,全周微跌0.29点.

周成交量则减少17%.

综指在周四,见低点1342点;8月期货则低位见1338点.

过去已提过只要指数不跌破1335点,指数任处于小3浪的运行模式.

而当前1360点的反弹,短线观点上已经达标,指数再攻顶(1370)的机会是有但可否站稳就有难度.

短线,指数在1360-1340点范围横盘整理属于合理现象.

如不辛失守1342点,再创低位;

形成一浪底于一浪的走势,那就是指数明示转弱的迹象.

那下道支持在1328点,这也推翻之前推演是小3浪的运行模式.

这是股友须多加留意的细节,一旦察觉就须从新推算走势.

以均线系统观察,综指短期任偏弱,中长期依然处于上升趋势.

预计综指接下来这周波动范围在1337-1382

阻力在1363,1374,1385

支持在1350,1346,1343

大马股票市场宽度:

目前股价高于50日均线比列是61.5%

和前5个交易日比较减少了4.2%.

这是第二周出现减幅,幅度也在扩大中.

虽然综指周五全面回弹,但很明示的并没对大部分股票带来激励.

更细腻的挑选分析(均线必须保持前进势头),股价同时高于10日均线和50日均线的股项比列是3.6%.

和前5个交易日的9%对比,减少4.6%.

强势股继续退温,如股友持的股项依然处于稳建状态,无须过度惊慌抛售.

海峡指数(STI)本周只有四个交易日,周二开始跌势.

周三与周四也都出现跌空走势,周五小反弹以2939.97点挂收.

全周跌55点,跌势较为凌厉.

海指在触及3043点后,基本小3浪形态已吻合.

前周提过"如海指调整失守2958点,是走势明确转跌迹象"

海指目前已进入调整期,短线会有小反弹,但反弹力度局限在3000点之下.

在形态上,海指应守在2890之上.

下周的波动范围在2861-3018.

预计8月分,海指月波动范围在2754-3220.

海指短期阻力在2964,2979,2994

支持在2916,2906,2874.

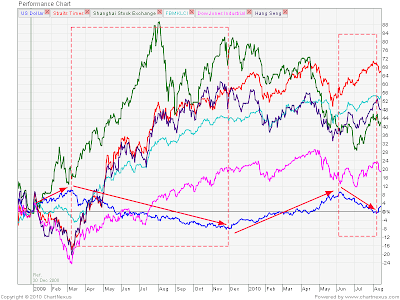

宏观面,亚洲股市已进入调整状况,货币逐步回弱(包括欧元).

反之美元却明示走强.

这和股指有不可分割连贯关系,这可作为参考指标.

如加入商品指数会察觉更多连贯效应.

当经济局势不明朗时,游资就会流向美国债券.

这也是美元逐步走强的应素之一.

以2010年至8月为列,美债和S&P500回报率比对.

美债回报率6.95%,反观S&P500下跌3.2%.

美债基本上是跑赢S&P500,美债吸引力就在这里.

本季度,美国要筹3500亿,第4季度要筹3800亿.

接下来这周,美国会继续拍债,如股友是希望DJI或S&P500做强势反弹,机率不高.除非有极为利好的政策出台.

Investing is an art and highly emotional and subjective.

When buying stocks, if your buying decisions are based on"insiders' information or rumours" and not sound analysis, then you are gambling. Many investors enter the market when stocks prices are high (lacking of confidence to enter beforehand when prices were low). Once the stocks market crash, they tend to sell out their shares out of fear and pessimism, swearing to "chop off their fingers" and never enter the stocks market again. If such situation happens, all their previous gains may be wiped out and suffered a loss.

Investing is an art and highly emotional and subjective. Subjectivity is largely controlled by our emotions. There are times when we are optimistic or pessimistic. If we are unable to control our emotional weakness, we are unlikely to become successful investors.

To be successful, you must first understand yourself, in particular your emotions and the degree of pressure you can tolerate.

The investors should also analyse the country's economic prospects together with the earnings outlook of the major listed companies.

It is imperative that you like Mathematics as the sound mathematical knowledge plays a key role in investment.

财富為了实现梦想;而非梦想拥有财富 .

美元对亚洲货币走势图

Investing is an art and highly emotional and subjective. Subjectivity is largely controlled by our emotions. There are times when we are optimistic or pessimistic. If we are unable to control our emotional weakness, we are unlikely to become successful investors.

To be successful, you must first understand yourself, in particular your emotions and the degree of pressure you can tolerate.

The investors should also analyse the country's economic prospects together with the earnings outlook of the major listed companies.

It is imperative that you like Mathematics as the sound mathematical knowledge plays a key role in investment.

财富為了实现梦想;而非梦想拥有财富 .

美元对亚洲货币走势图

Live Economic Calendar Powered by the Forex Trading Portal Forexpros.com

Sunday, August 15, 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment